2025 Hsa Contribution Limit

2025 Hsa Contribution Limit. You must have an eligible high. For 2025, individuals can contribute a maximum of $4,150 to an hsa.

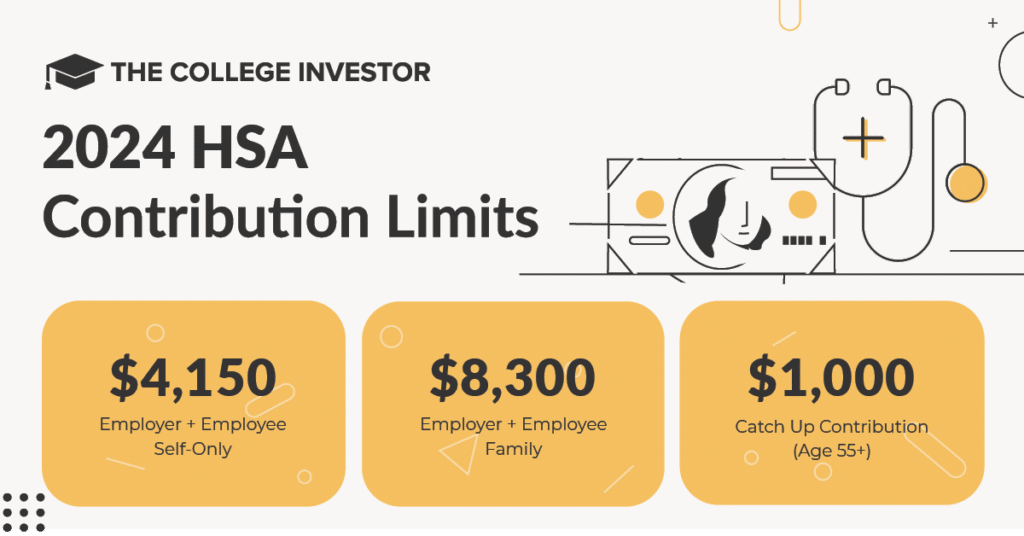

If you have family coverage, you can contribute up to $8,300. Hsas are a type of account you can open if you have a health insurance deductible above a certain threshold — $1,600 for individuals in 2025 — and want to grow a.

New HSA/HDHP Limits for 2025 Miller Johnson, For 2025, individuals under a high deductible health plan (hdhp) have an hsa annual contribution limit of $4,150. What are the fsa and hsa contribution limits for 2025?

The Best Order of Operations For Saving For Retirement, And if you age 55 or better, you can still make a catch. Hsas are a type of account you can open if you have a health insurance deductible above a certain threshold — $1,600 for individuals in 2025 — and want to grow a.

2025 HSA & HDHP Limits, If i continue to invest $345 a month (the max i can based on 2025 contribution limits) into a target date fund, by 2050 (or in 26 years), i'd have about $345,000 in my account,. If you are an eligible individual who is age 55 or older at the end of your tax year, your contribution limit is increased by $1,000.

Tabela Atualizado Irs 2025 Hsa Limit IMAGESEE, The new 2025 hsa contribution limit is $4,150 if you are single—a 7.8% increase from the maximum contribution limit of $3,850 in 2025. Explains the changes in health savings account (hsa) contribution limits for 2025.

Significant HSA Contribution Limit Increase for 2025, If you are an eligible individual who is age 55 or older at the end of your tax year, your contribution limit is increased by $1,000. Your contribution limit increases by $1,000 if you’re 55 or older.

self directed 401k contribution limits 2025 Choosing Your Gold IRA, If i continue to invest $345 a month (the max i can based on 2025 contribution limits) into a target date fund, by 2050 (or in 26 years), i'd have about $345,000 in my account,. If you are an eligible individual who is age 55 or older at the end of your tax year, your contribution limit is increased by $1,000.

IRS Raises HSA Contribution Limits for 2025 Due to High Inflation, Hsa contribution limit for self coverage: For 2025, individuals under a high deductible health plan (hdhp) have an hsa annual contribution limit of $4,150.

HSA/HDHP Limits Will Increase for 2025, If you are an eligible individual who is age 55 or older at the end of your tax year, your contribution limit is increased by $1,000. Hsa contribution limits for 2025.

IRS Announces 2025 Limits for HSAs and HDHPs, If your employer contributes to your hsa or fsa on your behalf, this may impact how. Hsa contribution limits for 2025 are $4,150 for singles and $8,300 for families.

IRS Announces HSA Limits for 2025, Annual deductible must be $3,200 or more. Annual hsa contribution limits for 2025 are increasing in one of the biggest jumps in recent years, the irs announced may 16:

Health savings account (hsa) and flexible spending account (fsa) contribution limits for 2025 are higher than they.

Hsas are a type of account you can open if you have a health insurance deductible above a certain threshold — $1,600 for individuals in 2025 — and want to grow a.